Last Week in Review

Last Week in Review: Consumers pull back on retail spending, while home loan rates hit their lowest levels of the year.

Forecast for the Week: Housing and manufacturing will fight for a headline in the midst of geopolitical events.

View: Activate those brain cells when you have 30 minutes. “I like spending my money.” The Beach Boys. Consumers were holding back on purchases again in March, while home loan rates hit their lowest levels of the year.

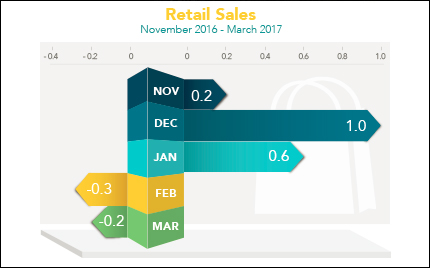

Retail Sales fell for the second month in a row, the worst two-month stretch in two years. The Commerce Department reported March Retail Sales decreased 0.2 percent from February. January to February also was revised from the previously reported increase to a decrease of -0.3 percent. These negative numbers could be significant once first quarter Gross Domestic Product is released later this month, as consumer spending makes up two-thirds of overall economic activity. Despite the declines, total sales for the first quarter were up 5.4 percent from the same period a year ago.

Retail Sales fell for the second month in a row, the worst two-month stretch in two years. The Commerce Department reported March Retail Sales decreased 0.2 percent from February. January to February also was revised from the previously reported increase to a decrease of -0.3 percent. These negative numbers could be significant once first quarter Gross Domestic Product is released later this month, as consumer spending makes up two-thirds of overall economic activity. Despite the declines, total sales for the first quarter were up 5.4 percent from the same period a year ago.

Inflation was tame in March on both the wholesale and consumer levels. The Producer Price Index decreased 0.1 percent in March while the Consumer Price Index fell 0.3 percent, the Bureau of Labor Statistics reported. Tame inflation is typically good news for Bonds, as inflation reduces the value of fixed investments. Since home loan rates are tied to Mortgage Bonds, they can also benefit when inflation remains cool.

In other important news, uncertainty over the tensions surrounding global events caused investors to move their money into the safer haven of the Bond markets before heading into the holiday weekend.

At this time, home loan rates have hit 2017 lows. If you or someone you know has any questions on home loan rates or products, please contact me. I’d be happy to help.

Housing and manufacturing reports will dominate a busy week, along with continued uncertainty around the globe.

-

Manufacturing data kicks off the week with the Empire State Index on Monday, followed by the Philadelphia Fed Index on Thursday.

-

Housing numbers will come from the NAHB Housing Market Index on Monday, Housing Starts and Building Permits on Tuesday, and Existing Home Sales on Friday.

-

The Fed’s Beige Book will be delivered on Wednesday.

-

As usual, weekly Initial Jobless Claims will be released on Thursday.

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve. In contrast, strong economic news normally has the opposite result. The chart below shows Mortgage Backed Securities (MBS), which are the type of Bond on which home loan rates are based.

When you see these Bond prices moving higher, it means home loan rates are improving. When Bond prices are moving lower, home loan rates are getting worse.

To go one step further, a red “candle” means that MBS worsened during the day, while a green “candle” means MBS improved during the day. Depending on how dramatic the changes are on any given day, this can cause rate changes throughout the day, as well as on the rate sheets we start with each morning.

As you can see in the chart below, Mortgage Bonds pushed to 2017 price peaks, driving home loan rates to their lowest levels of the year.

3 Brain-Boosters on a 30-Minute Break

Taking regular breaks during the workday can lead to lower stress levels and better focus. In the last two weeks, we’ve shared a few ideas on what you can do to boost brainpower on five- or 15-minute breaks. This week, we offer three options to consider when you have 30 minutes:

Take a class. New ways to continue your education are constantly coming online, and many are a fraction of the costs of attending in person. Coursera and edX offer classes from top universities, while Open Culture links free courses, audio books, e-books and more.

Write thank you notes. Grab some note cards and tell clients or colleagues how much you appreciate them. Thinking about what you’re grateful for in others (and letting them know!) is an effective way to ease workday stress.

Plan your weekend. Rather than let the weekend bring what it will, give yourself something to look forward to. Map out a mini road trip or schedule a barbecue with family and friends. Use the time to plan out the menu and send out emails or texts to invite people over.

Get more from your breaks with these great ideas!

Source: Entrepreneur

Economic Calendar for the Week of April 17 – April 21

|