Blog

MBS Day Ahead: Every NFP Week is Important Until Fed Hike (or Lack Thereof)

Back in 2015–almost exactly a year ago, actually–the order of the day was determining the timing of the Fed’s first rate hike since the financial crisis. By late October, we knew the hike was finally coming in December. Investors figured the Fed would deliver the news in a

Inventory and Appraisal Issues Complicate Existing Sales

“Frustratingly low inventory levels in many parts of the country” assume the fault from the National Association of Realtors® (NAR) for a drop in July existing home deals, the first loss following four straight months of gains. Resales of single-family homes, townhomes, condominiums, and com

Mortgage Rates Rise Slightly on Strong Jobs Report: Freddie Mac

Mortgage rates were little changed from the previous week as they rose two basis points on better-than-expected economic news, according to Freddie Mac. The 30-year fixed-rate mortgage averaged 3.45% for the week ending Aug. 11, up from last weekwhen it averaged 3.43%. A year ago at this time, the 30-year fixed-r

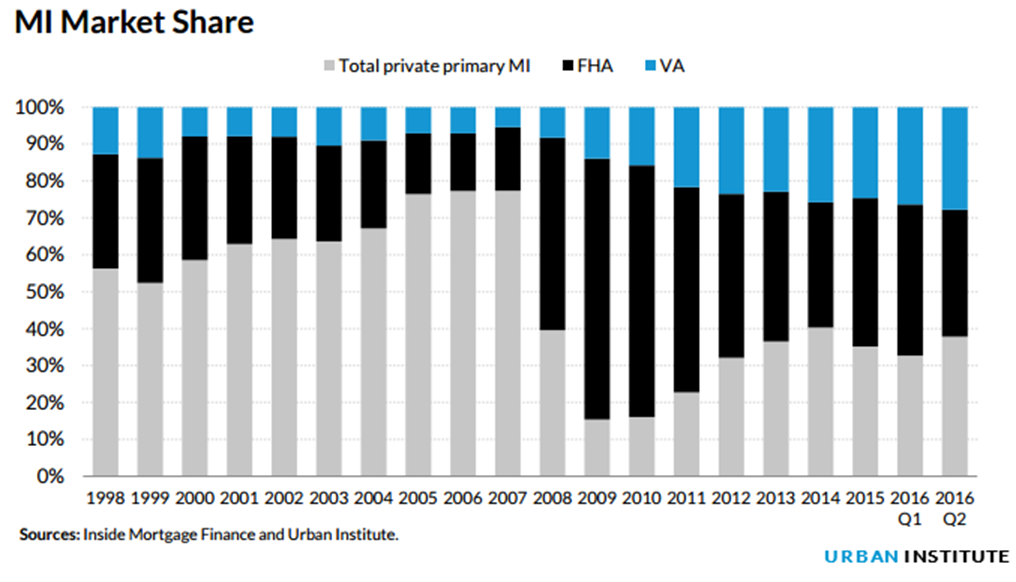

Resurgence of PMI Could Force FHA to Cut Premiums

In last month’s Housing Finance Chartbook the Urban Institute showed how a recent surge in issuance of private mortgage insurance (PMI) had come at the expense of the Federal Housing Administration’s (FHA’s) Mortgage Insurance Fund (MIF). PMI grew from a 33 percent share of the market in Quarter

Mortgage Rates Near 2-Month Lows

Mortgage Rates maintained their recent winning streak today, falling for the 5th straight day. The average lender is now offering the best rates in nearly 2 months. You’d have to go back early August or late July (depending on the lender) to see a better combination of rate and upfront

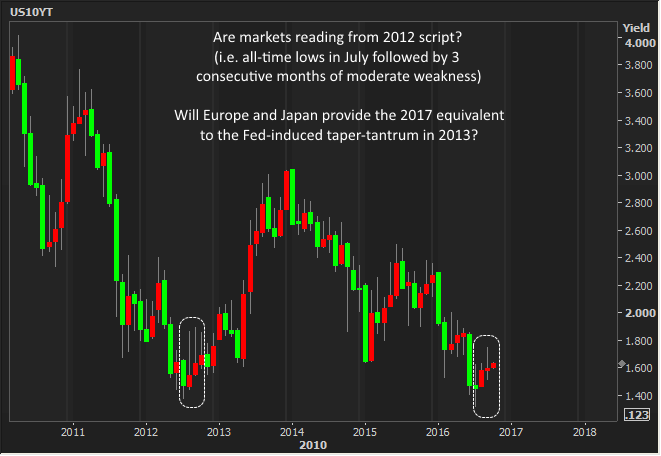

MBS Day Ahead: Are Bond Markets Reading From Same Scary Script?

There are no significant economic reports or scheduled events on tap for today. This will give us an opportunity to feel out the new trading ideas, not only for the rest of the week (which ends with Friday’s NFP), but for the month of October in general. It turns out that October is historic

‘Massive’ shortage of appraisers causing home sales delays

Housing demand is rising rapidly, but a key cog in the wheel to homeownership is in deep trouble. The people most needed to close the deal are disappearing. Appraisers, the men and women who value homes and whom mortgage lenders depend upon, are shrinking in numbers. That is causing growing delays in closings, co

1 in 10 borrowers may be missing out on mortgage savings

The average rate on the popular 30-year fixed mortgage has been so low for so long that a good chunk of borrowers can't even contemplate the idea of it ever going higher. Why should they? Every time we warn of rising rates, or see a tiny bump up, some global economic tantrum pushes them back down. Most borrowers

Check Out Our Niches

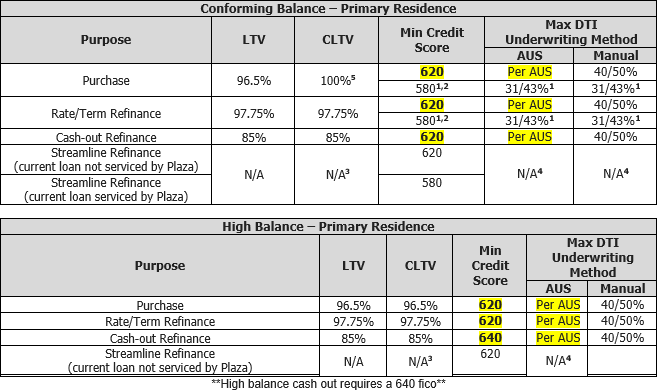

Agency Require only one FICO for each borrower and an AUS approval DU or LP Permitted Gift Funds: only copy of donor's check required if funds are in borrowers account at submission or sent to title (FHA requires bank statements) 2016 Expenses Not Counted: OK when bonus, OT & commissions are less than 25% o

New FHA Guidelines

620 fico – DTI’s allowed up to AUS maximum 56.99% approved eligible!!! 580 fico – DTI’s allowed up to 40/50 with compensating factors!!! USDA Streamline Assist Now Available at NORTHSTAR FUNDING INC NORTHSTAR FUNDING INC Offers USDA Streamline Product: 'Streamline Assist' Don't forget NOR

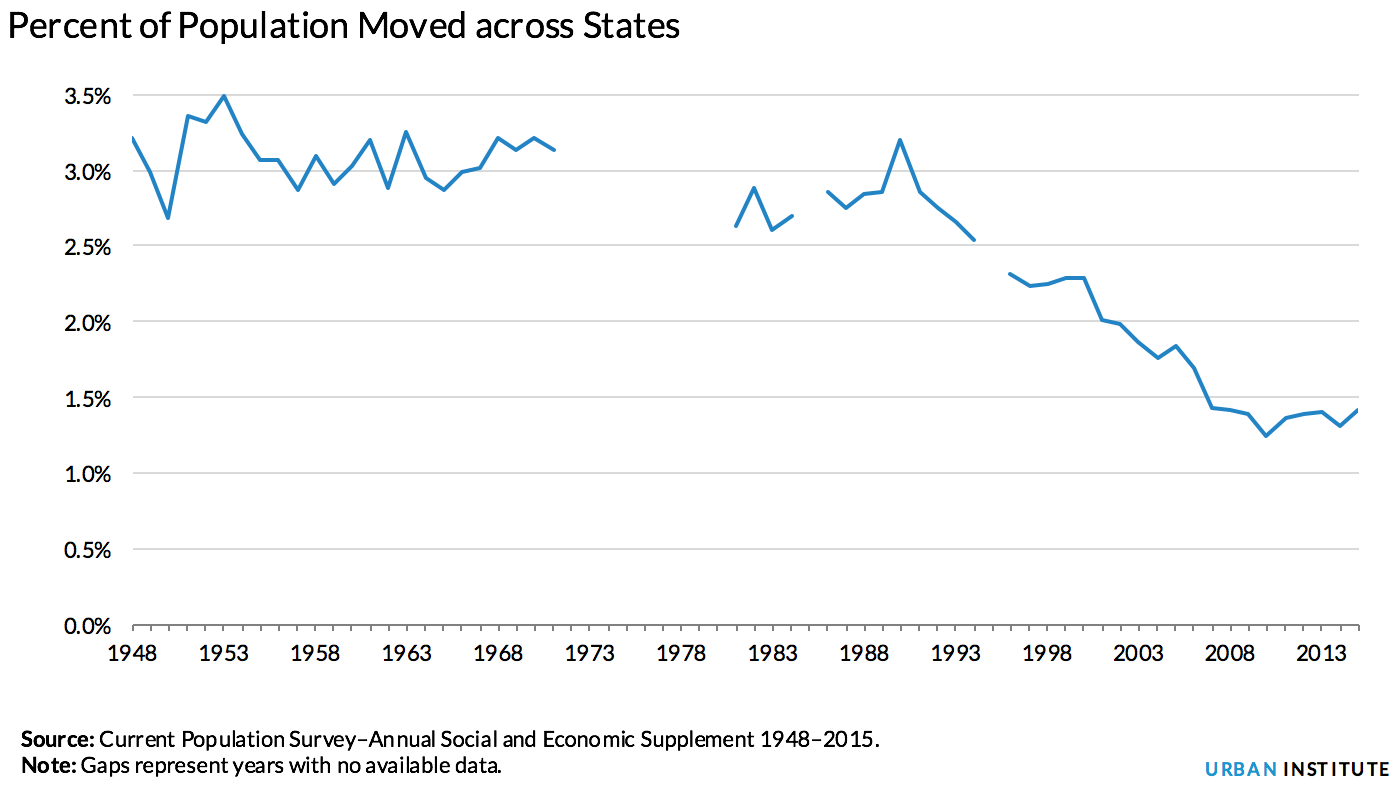

How Decreasing Migration Affects The Mortgage Market

Americans are staying put, both in their homes and in their jobs. The two appear to be related but which is the driving force? In a recent Urban Institute blog researcher Bhargavi Ganesh points to the decreasing incidence of state-to-state migration, a trend that started in 1990. Her cites research from Raven Mol

The Dos & Don’ts Of Credit Scores

Here are some important facts about credit scores you should know! Don't Apply For New Credit during the loan process. Every time that you have your credit pulled by a potential creditor or lender, you can lose points from your credit score immediately. Don't Close Credit Card Accounts. If you close a credit card