Blog

Freddie & Fannie Loans Compared

FREDDIE/LP Loans FANNIE/DU Loans NEW! BORROWER CONTRIBUTION - No minimum on primary >80% with or without non-occupant BORROWER CONTRIBUTION - from the borrower's own funds is not required - al

Specialized Financing for Stick-build, Modular and Manufactured Homes

FNMA, FHA & FINANCING AVAILABLE Permanent loan is closed before home is built. Creating new opportunities for more qualified borrowers As low as 3.5% down payment for FHA Zero down payment for VA with no mortgage insurance for most veterans Credit Scores as low as 530 for FHA and VA Borrower ma

MMG Weekly: Report Card in for 2016 Housing, GDP

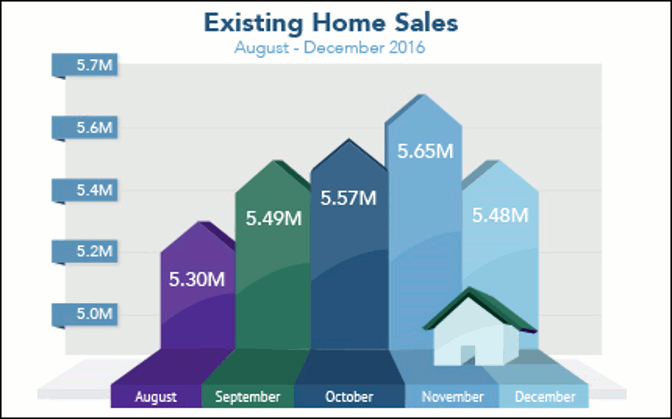

Last Week in Review "Turn this house into a home." Luther Vandross. Existing Home Sales and New Home Sales followed a similar path downward in December. But the latest housing reports still had good news to share. Existing Home Sales closed out 2016 as the best year in a decade, though December's numbers were bel

HOMEREADY & HOMEPOSSIBLE Income & Property Eligibility

https://homeready-eligibility.fanniemae.com/homeready/ http://freddiemac.com/homepossible/eligibility.html ? Put the address of your subject property into the HOMEREADY & HOMEPOSSIBLE Income & Property Eligibility tool and if the income limit works for your loan then this product prices out MUCH better th

Purchase Power!!

3% Down* Reduced MI Coverage - 25% FTHB ALLOWED Down Payment Can Be A Gift 50% DTI Allowed* Conforming & High Balance Time To Get Home-Ready!

Our SELECT 24 Month Bank Statement Program

Self Employed Borrower Salaried Co-Borrower Allowed Personal and/or Business Bank Statements Allowed Interest Only & Fully Amortized 5/1 LIBOR ARM Purchase, Rate & Term Refinance and Cash Out Ask your Account Executive for Cash Out Maximum in Hand Owner Occupied, Vacation/Second Home, & Investment P

Last Week in Review

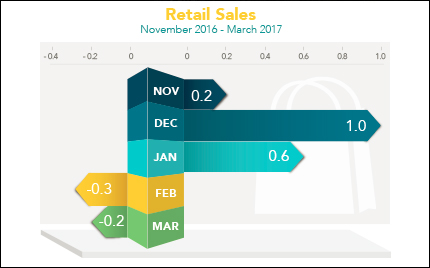

Last Week in Review: Consumers pull back on retail spending, while home loan rates hit their lowest levels of the year. Forecast for the Week: Housing and manufacturing will fight for a headline in the midst of geopolitical events. View: Activate those brain cells when you have 30 minutes. "I like spending

7-Year ARM Rates Best For Modern Homeowners

Many Homeowners Skip Over 7 Year ARM Rates If you're looking for a house but expect to be in it only for a limited time, you might pay more with a standard 30-year fixed mortgage than you require to. A 7-year adjustable rate mortgage (ARM) could lower your monthly expenses and give you options down the road.

Thank You for 10 Wonderful Years!

A letter from our President - Joseph M. Pisa On behalf of the entire Northstar Funding team I would like to take this opportunity to thank each and every one of our business partners and most importantly, our clients. Even through all the ups and downs (and the market has definitely provided plenty of both), it's

More Buyers are Achieving Home Ownership with HomeReady

HomeReady Mortgage is a Fannie Mae Program and offered by Northstar Home Funding General Terms and Guidelines to Review: 97% financing purchase -1 unit /Owner Occupied. No minimum borrower contribution (1 Unit properties) - use flexible sources of funds for down payment and closing c

Today’s Market Indicators – Are you Ready?

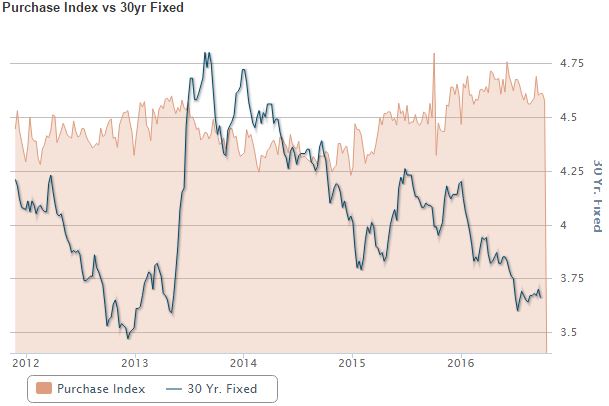

Strong Market Starts Next Week Will Tell if this Gets Even More Exciting - Stay Tuned! Matthew Graham, CEO of Mortgage News Daily, compares the similarities of the 2013 bond sell off to today's market patterns and makes the case for a Bounce. Read the full article here at Mortgage Daily News! http://bit.ly/2pG0ih

Home Sales in Bloom – Home sales were strong, while GDP was a disappointment.

New Home Sales blossomed in March reaching their highest level in nearly a year, the Commerce Department reported. Sales were up 5.8 percent from February and nearly 16 percent from a year ago. New home inventories edged lower to a 5.2-month supply in March. A six-month supply is considered "normal" inventory. Ex