Blog

Don’t Worry, Housing Only “Feels” Unaffordable

Housing, at least according to Freddie Mac vice president and chief economist Sean Becketti, isn't unaffordable. It just feels that way. Becketti, in a recent post on the company's Perspectives blog, says the media is full of headlines that decry the costs faced by homebuyers today.&nbs

Pitiful Housing Supply Slighted Dampened Q2 Home Sales

Headstrong is a rather interesting word, but the National Association of Realtors® (NAR) chose it to describe the continuing imbalance between supply and demand in the housing market. NAR blames this imbalance for slightly tempering home sales as well as pushing continued robust price growth i

Refis Enjoy Nice Bounce Thanks to Lowered Rates

BY: JANN SWANSON There is still life left in refinancing. While at nowhere near the levels of a few years ago, Ellie Mae's Origination Insight Report for July reported that the percentage of loans that were for refinancing increased by three points to 35 percent. That gain followed two

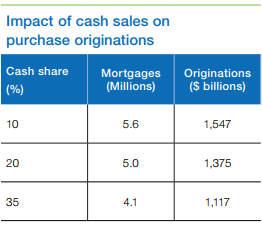

Freddie Mac Puts Price on All-Cash Transactions

BY: Jann Swanson As investors flooded into the housing market after it collapses, they brought cash with them. At one point, 35 percent of home sale transactions were closed without a mortgage, i.e. were all-cash sales. Home prices are up, the bargains are gone, but cash sales remain significantl

Freddie moves ahead with appraisal alternative for purchases

Freddie Mac has gotten the go-ahead from the Federal Housing Finance Agency to launch an appraisal alternative for qualifying purchase mortgages. The FHFA on Friday confirmed that it has approved Freddie's plan to make its automated collateral evaluator available for qualified home purchases starting Sept. 1. Fre

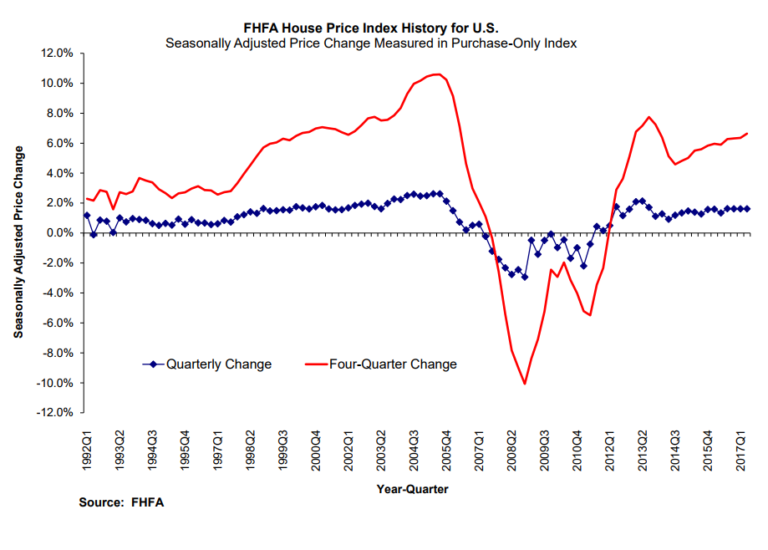

Home Price Gains Slow on FHFA Index

The Federal Housing Finance Agency (FHFA) reported on Tuesday that home prices were up in 48 states and the District of Columbia during the second quarter of 2017. The agency said that its Housing Price Index appreciated 1.6 percent compared to the first quarter of the year. Year-over-ye

Mortgage Rates Highest in 9 Months

Mortgage rates were only moderately higher today, but the move was enough to officially bring them to the highest levels since the Spring of 2017. In other words, most lenders' rate quotes are fairly similar to recently bad days (like last Wednesday), but in terms of outright costs, you'd have to

How Much Would Bonds Need to Rally to Suggest a Broader Bounce?

The short answer is "to 10yr yields below 2.66% and ideally below 2.49%." Those are the levels we'd need to see in order to suggest a more substantial move lower in rates. Unfortunately, the more germane questions involve rates on the other end of the spectrum. The first of those questi

How the GOP Tax Bill Affects Individual Taxpayers In 2018

President Trump signed his tax reform into law on December 22nd. You may already see changes in your take-home by the end of February. On top of lower tax rates, the bill nearly doubles the standard deduction to $12,000 for individuals and $24,000 for married couples: Single $0 – $9,525 (10%) $9,5

Interest on Home Equity Loans Often Still Deductible Under New Law

The IRS has advised taxpayers that in many cases they can continue to deduct interest paid on home equity loans. Responding to many questions received from taxpayers and tax professionals, the IRS said that despite newly-enacted restrictions on home mortgages, taxpayers can often still deduct interest on a

It’s Tax time! Here are a few links for information you may find useful for this time of year.

Popular Tax Benefits An Old Tax Scam Tax Breaks You Can Still Take Deductible Under New Law

Fannie Mae Potentially More Prohibitive on Ratios Over 45%

Desktop Underwriter/Desktop Originator Version 10.2 Release Please be aware of the latest version of DU (DU Version 10.2) is going live this weekend. It is possible that it may become more challenging to get Approved/Eligible findings with ratios over 45%. Please see the complete Release Note