Category: Blog

Use The Slower Real Estate Market To Your Advantage

According to the National Association of Realtors, existing home sales rose strongly in September. But the winter and holiday months are typically a slower time of year for real estate. That can work to the buyer’s advantage, though. Fewer real estate transactions can translate to less compet

Purchase Apps Surge, Driven by Jumbos

Purchase mortgage application activity picked up significantly during the week ended November 18. The Mortgage Bankers Association said its Market Composite Index, a measure of application volume, increased 5.5 percent on a seasonally adjusted basis from the week ended November 11 and was up 3.0 percen

FHFA Announces Increase in Maximum Conforming Loan Limits for Fannie Mae and Freddie Mac in 2017

Washington, D.C. – The Federal Housing Finance Agency (FHFA) today announced that the maximum conforming loan limits for mortgages acquired by Fannie Mae and Freddie Mac in 2017 will increase. In most of the country, the 2017 maximum loan limit for one-unit properties will be $424,100, an increase

Long-Gone Mortgage Trends, Ideas Could Make Comeback in 2017

2017 looks to be trending in a direction you will want to watch closely. This article claims that some of the debt cycles may be creeping back into the market. Take a look and decide what you think but still a great time to buy or refi before any major market shifts. Everything old is new again in the mortgage i

Did you know? Northstar Funding offers a 1% Down Conventional loan.

Did you know? Northstar Funding offers a 1% Down Conventional loan. Here's how it works: Borrower puts down 1%, Northstar Funding contributes 2% towards the down payment, giving them 3% equity at closing 700+ FICO, 43% max DTI (debt to income ratio) Available with no monthly Mortgage Insurance For more i

Current Position: Carefully Floating

Stocks are lower and mortgage Bonds are higher, recovering most of Friday’s losses, so far this morning. It’s a quiet new day and relatively quiet news week, highlighted by the Producer Price Index, Retail Sales, several Fed speakers, and a 10-year Treasury Note Auction and 30-year Bond Auction. The M

Federal Reserve Outlook

The Federal Reserve met today and decided that the Federal Funds Rate will remain low - holding steady between 0.50% and 0.75%. Since financial market experts predict several rate increases in 2017, now is the time to get your finances in order before mortgage rates rise. Don't miss out on this opportunity to lo

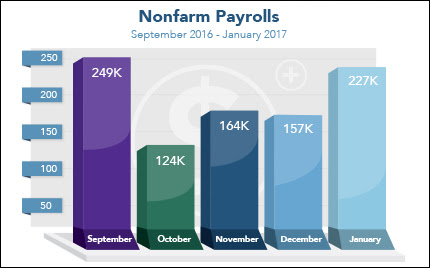

Job Growth Jumps. Wage Growth Weakens.

In This Issue Last Week in Review: While more Americans found jobs in January, they still may be looking to add more to their paychecks. Forecast for the Week: Markets may take a breather in a quiet economic news week. View: Free stock photo sites for picture-perfect marketing and presentations. Last Week in Revi

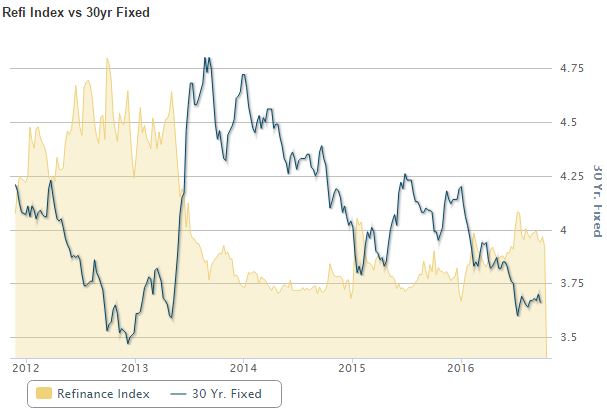

Mortgage Rates Drop to 2-Week Lows

Mortgage rates moved lower today as investors sought safe haven from global political risk in the bond market. When investor demand for bonds increases, rates generally fall, all things being equal. Today's improvement was fairly healthy, too. You'd have to go back to January 23rd--exa

Lock, Shop & Drop Loans

Our Lock, Shop, and Drop program combines 3 different features into one easy tool that will set you apart from all the other buyers when speaking with agents and builders. Most people are saying the same thing…. reliable, access to investors that can close on time and deliver the rate they

We Have Loans for Borrowers Just 1 Day out of a BK or Even a Foreclosure! No Seasoning Requirements!

Loan Amounts up to $1 Million No mortgage/rental payment history required Multiple derogatory events within 2 years allowed 85% LTV Purchase or R&T Refi down to 660 FICO 80% LTV Purchase or R&T Refi down to 620 FICO 70% LTV Purchase or R&T Refi down to 580 FICO 80% LTV Cash Out Refi do

Benefits of Netting Escrow

Benefits of Netting Escrow Netting a borrower’s escrow during refinancing can make the process quicker. Instead of paying the new escrow amount out of pocket, a borrower can net, or apply the escrow balance from the original loan, using these funds to cover the difference for the new escrow account. Dependi