Category: Blog

FHFA Calls For Big Changes to Fannie/Freddie Conservatorship

Federal Housing Finance Agency (FHFA) Director Mel Watt had three messages for the U.S. Senate Committee on Banking, Housing, and Urban Affairs on Thursday: Fannie Mae and Freddie Mac (the GSEs) are not the companies they were before they were put in conservatorship Congress needs to act urgently on housing fina

Creative Loan Financing Options

Call us today to review any of these creative loan offerings and requirements for each! 1. Agency Near Misses(Use Agency Plus for conventional and jumbo loans that don’t quite fit agency guidelines) 2. RE Investors(use DSCR to qualify - No personal income, no tax returns needed) 3. Self Employed(No W2,

More options. Better service. Fewer overlays.

NorthStar Funding, Inc. works with many national lenders and several production channels to meet your company’s business model. From Wholesale to fully-delegated Correspondent lending, NorthStar provides a wealth of options that enable you to improve your revenue and production. No mini

Mortgage Rates Rise Gently From 7-Month Lows

Financial markets are still reeling from political headlines that first began circulating on Tuesday afternoon. While stock markets made a reasonable attempt to retrace yesterday's big move lower, bond markets weren't as interested. Fortunately, that means mortgage rates moved modestly higher, leaving t

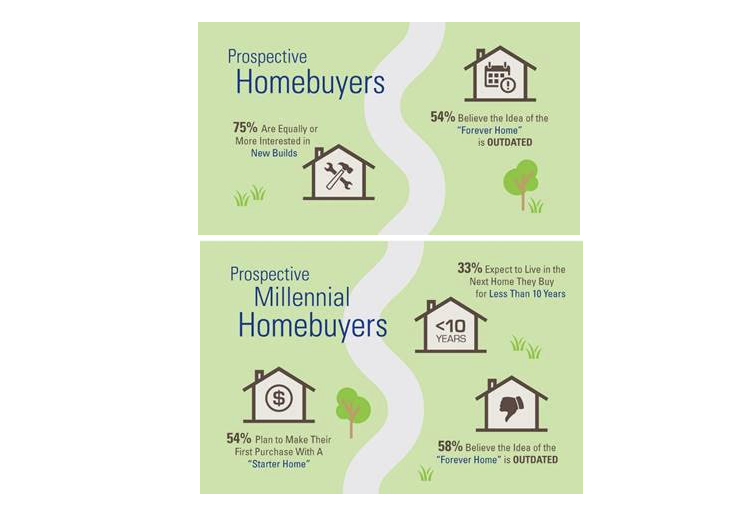

RIP Forever Homes: Millennials More Inclined to Move

Say goodbye to the idea of a “forever home.” No, I’m not talking about taking home a rescue pup. Instead, I’m referring to the antiquated idea of buying that dream house and living there forever. A recent community survey from Taylor Morrison shows that over half (56 pe

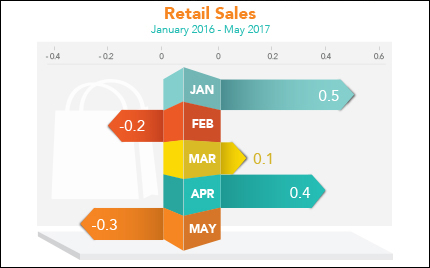

MMG Weekly: Retail Sales and Housing Starts Disappoint

Last Week in Review: The cha-ching didn’t register at retailers in May. Housing Starts disappointed. Inflation remained tame. “Don’t bring me down.” Electric Light Orchestra. Despite gains in April, consumers slowed down their purchases in May. Remember: Weak economic news normally ca

Freddie Singing a Different Tune on Housing/Mortgage Outlook

On November 30, 2016 Freddie Mac's economists issued their monthly Outlook which, in light of the sudden surge in interest rates earlier that month, was decidedly gloomy. MND's coverage of the forecast elicited a lot of concern from readers, especially when we quoted Freddie Mac that, un

Bonds Look to Data and Month-End For Breakout Potential

Whereas the previous week was generally devoid of significant economic data or market moving events, the current week is more of a contender. On the data front, there are relatively important reports throughout the week including a key inflation report on Friday (PCE). Given the extent to which Fed sp

Falling Demand, Competition, Push Lenders Toward Easing Standards

As home buying affordability has declined, it has indirectly moved lenders' apparent willingness to loosen credit standards in the opposite direction. Fannie Mae says its second quarter Mortgage Lender Sentiment Survey shows the net share of lenders reporting they have eased credit standards over the p

Perceived Sellers’ Market Could Lead to Inventory Gains

Is there relief in sight for those oft cited, much maligned tight housing inventories? The National Association of Realtors® (NAR) sees a glimmer of hope in the responses it received to a recent survey. The Housing Opportunities and Market Experience (HOME) survey for the second quar

Check Out Our Low Down Payment Options!

Down payments as low as 3% Conventional: 3% down with min. 620 FICO HomeReady: 3% Down payment can come entirely from a gift (Same min. FICO applies) Home Possible Advantage: Purchase & refinance loans up to 97% LTV for SFR only Home Possible: For 1-4 unit properties up to 95% LTV VA: 100% fina