Category: Blog

Conforming Plus Future Income Program

The Conforming Plus Future Income program allows a borrower to close a loan 120 days prior to starting their new job. NOTE: The Future Income Program is ONLY to be used when the borrower does not start their job until AFTER the loan funds. AUS Findings Desktop Underwriter Approve/Eligible only. - A

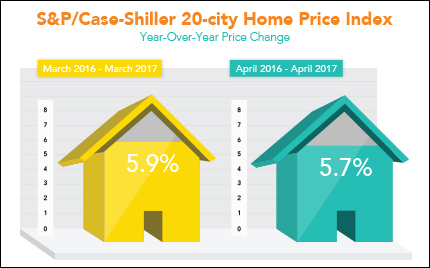

Home Prices Rise

"A house with love in it is rich indeed." Nat King Cole. Families may find themselves living on love as they invest more on increasing home prices. The S&P/Case-Shiller 20-City Home Price Index saw another gain of 5.7 percent from April 2016 to April 2017. Price increases are due in part to limited supp

MBS RECAP: Curse Broken? Bonds Waiting on Data to Confirm

Bond markets found their first green day since June 27th today and for no particular reason apart from today being the first full trading day in July. That assertion comes courtesy of the volume and volatility seen during the various opening and closing times for stocks and bonds. First up, we had the

MBS RECAP: Bonds Build Case for Support After Yellen

"Support" and "resistance" are two terms often thrown around in market analysis. They loosely refer to ceilings and floors respectively (as far as rates are concerned), but it's slightly more complicated than that (as covered in our primer on MBS Live). The gist is that ceilings and floors can st

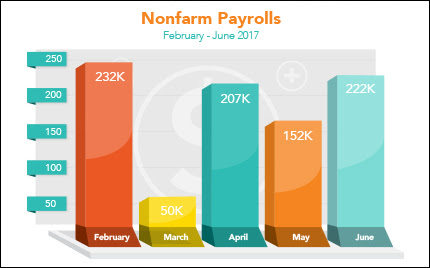

Job Growth Soars in June

"Let's work, be proud. Stand tall, touch the clouds." Mick Jagger. More Americans were headed to work, but take-home pay stayed about the same. Employers added 222,000 new jobs in June, well above expectations, the Labor Department reported. April was revised up from 174,000 to 207,000, and May was revised u

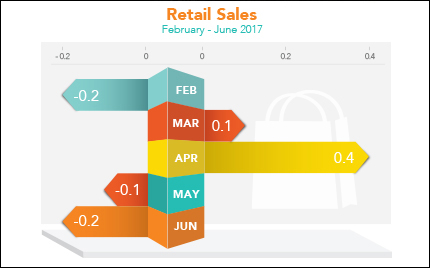

Retail Sales Weak. Inflation Tame.

Last Week in Review: "Just shopping. Not buying anything." The Dramatics. Consumers are spending more than last year, but sales from month to month don't register consistently. June Retail Sales fell 0.2 percent from May, the second monthly decrease in a row, though they were 2.8 percent above June 2016 per

Views : You can Use

Housing Highs, Spending Lows May Existing Home Sales rose from April to an annual rate of 5.62 million units, above the 5.52 million expected, and up 2.7 percent from May 2016. While New Homes Sales fared even better (see What to Watch below), the National Association of REALTORS® chief economist, Lawrence Yu

Loan Limits for Conventional Mortgages

The Federal Housing Finance Agency (FHFA) publishes annual conforming loan limits that apply to all conventional mortgages delivered to Fannie Mae, including general loan limits and the high-cost area loan limits. High-cost area loan limits vary by geographic location. General Loan Limits for 2017 The general loa

For Bonds, Worst Day Since Late June ECB Scare

Bonds sold off aggressively today, for a combination of reasons that are tremendously unsatisfying in a traditional market-watching sense. For example, it would be nice if we could point to something tidy and logical like all-time high stock prices, or the stronger Consumer Confidence data, but at

Refi Applications Strengthened on Last Week’s Lower Rates

A decline in purchase mortgage applications cancelled out most of a moderate increase in refinancing during the week ended July 21. Nonetheless, the Mortgage Bankers Association said its Market Composite Index eked out a slight gain. The Index was up 0.4 percent on a seasonally adjusted basis and 1.0 pe

Bonds Battle Back After Fed Foregoes Surprises

Today's focus was understandably on the Fed Announcement, and indeed, most of the movement followed it. But interestingly enough, the biggest volume spikes occurred at other times, and that helps explain the day's paradoxical movement. So what's the paradox? Quite simply, it made very little sense to see as

Mortgage Rates Up Slightly From Long-Term Lows

Mortgage rates rose moderately today as weekend news headlines suggested some measure of de-escalation of nuclear tensions between the US and North Korea. To be sure, the news wasn't resoundingly conciliatory, but investors took solace in it nonetheless. In general, when headlines suggest the worl