Category: Blog

Mortgage Rates Fall to New 2-Month Lows

Mortgage rates were lower yet again, making for an astonishing 10th consecutive day without rates moving higher. In the 13 days of rate sheets since the September 6th jobs report, rates have only risen once. After only being able to claim 6-week lows yesterday, today's rate sheets are the best in at l

Adjustable vs. Fixed

Which is the better mortgage option for you: fixed or adjustable? The low initial cost of adjustable-rate mortgages (ARMs) can be very tempting to home buyers, yet they carry a great deal of uncertainty. Fixed-rate mortgages (FRM) offer rate and payment security, but they can be more expensive. Here are some pros

Mortgage Rates’ Winning Streak Continues

Mortgage rates fell to new 3-Month lows today. That makes this the 11th straight day where rates have held steady or moved lower. As we noted yesterday, the burden of proof is on the scheduled economic data when it comes to determining whether or not the Fed is likely to move back toward its previous stance

Mortgage Rates Continue to New 3-Month Lows

Mortgage rates fell noticeably today, keeping alive an impressive streak of 13 days without higher rates. Three out of those 13 have been 'unchanged,' yesterday being one of them. There was a chance this marked a shift in the positive momentum, but financial markets were quick to get back on the 'lowe

What we’ve got here is a failure to communicate.

"What we've got here is a failure to communicate."Hopefully, that famous line from the 1967 movie Cool Hand Luke won't apply to our leaders on Capitol Hill, as they work toward a resolution on the debt ceiling debate and budget fight. Read on to learn what this could mean for home loan rates. Congress continues t

Federal Reserve would not begin tapering this month.

Last Wednesday, the Federal Open Market Committee surprised investors by announcing that the Federal Reserve would not begin tapering its $85 billion asset-purchasing program this month. Investors heaved a sigh of relief, and markets surged on the news. However, the gains lasted for only three trading sessions. M

Government Shutdown – How will this effect mortgages?

With the midnight deadline passing in Washington and a government shutdown in place many of you are wondering if this will cause problems for any mortgage transactions that are due to close during the shutdown. I have received a number of calls this morning with people asking this question. The answer is t

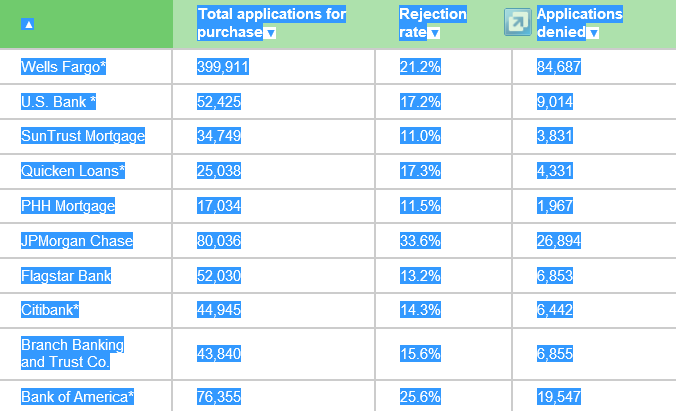

The bank that rejects the most mortgages

The likelihood that a mortgage application will be approved varies widely by bank. Home-buyer rejection rates ranged from 11% to 34% in 2012 at the 10 largest mortgage lenders, according to data released this month by the Federal Financial Institutions Examination Council. Those who applied for a mortgage at Sun

The Day Ahead: Back to Business as Congress Quickly Passes Debt Deal

Congress apparently thought the 10/17 debt ceiling deadline was a much bigger deal than financial markets. It's not that markets didn't perceive an actual default as a big deal--just that they'd already worked out that it would be at least another two weeks before any payee was at risk of not being paid by

Home Improvement Spending to Level in mid-2014

LIRA, a forward looking indicator of remodeling activity, continues to project a double digit annual increase in home improvement spending through this quarter and the first quarter of 2014, but cautions it expects a slowdown thereafter. LIRA (Leading Indicator of Remodeling Activity) has projected strong i

MBS MID-DAY: Yesterday’s Gains Doubled and Holding

After adding half a point yesterday, Fannie 3.5 MBS are up another half point today (Fannie 3.5s as of 11:55am) as the ill effects of the government shutdown and debt ceiling drama are priced out of bond markets. Both MBS and Treasuries have moved precisely to the narrow ranges that prevailed before the ons

Mortgage Rates Recover Yesterday’s Losses

Mortgage rates fell today, recovering yesterday's losses on average. Some lenders' rate sheets were just slightly better or worse than yesterday's latest, but nearly every lender had been worse this morning before releasing revised rate sheets in the afternoon. 30yr fixed best-execution remains at 4.3